Build vs Buy: The Real Cost of AI Agents for Accounting

(With the uncomfortable truth about data, privacy, and responsibility)

Introduction

Banking has already learned the hard way what many accounting firms are about to discover: when it comes to AI Agents, building from scratch rarely adds up.

In early 2025, WorkFusion revealed that ten of the world’s top twenty banks had chosen to buy AI Agents for compliance rather than build their own, and the logic behind their decision (which I’ll share in this article) applies perfectly to accounting.

Whether you’re a small bookkeeping firm or a Top 25 practice, the question isn’t if you’ll adopt AI Agents, it’s how. Should you build them in-house, or buy from specialists like Bots For That, where ready-to-deploy AI Agents such as houbeanie and the beanies suite already do the heavy lifting?

Let’s look at the maths and, crucially, the risk behind the numbers.

The Build vs Buy Equation

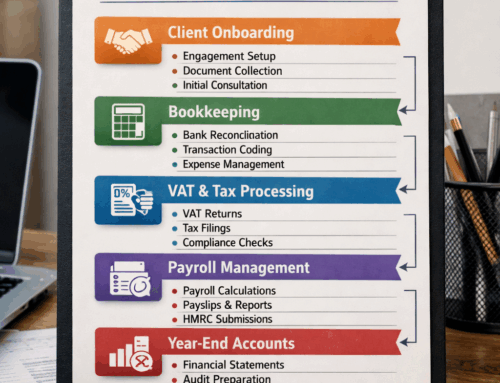

AI Agents can transform accounting workflows, automating reconciliation, onboarding, reporting, payroll, and advisory insights, but the path you choose determines your return on investment.

Build: the Multiplicative Path

Building your own agent might sound exciting, but it can be slow, expensive, and risky.

Each improvement adds up only incrementally: think 2, 4, 6, 8, 10, steady, but hardly spectacular.

To reach full value, you’ll need data engineers, prompt specialists, compliance experts, integrations across multiple systems, and a team to keep it secure and maintained. For most firms, that’s a costly distraction from their core purpose: serving clients.

And that’s before we even mention data security, because once you start building, you own the risk.

Buy: the Geometric Path

Buying pre-built agents can accelerate value. With a vendor solution like houbeanie, every additional automation compounds what came before. That’s geometric growth: 2, 4, 8, 16, 32, value that multiplies across teams and clients.

Instead of investing 18 months in development, you’re realising results within weeks. Agents evolve, learn, and scale without extra overhead. Your staff stay focused on client outcomes, not debugging APIs, or patching security holes.

The Data Dilemma: Privacy, Security and Accountability

Here’s the uncomfortable truth: AI isn’t just about efficiency, it’s about trust.

When an accounting firm deploys an AI Agent, that agent interacts with some of the most sensitive data imaginable, payroll records, tax returns, director salaries, shareholder details, even personal addresses and bank transactions. In other words: not just your data, but your clients’ data.

Yet, disturbingly, we still hear some accountants say, “We’re not really worried about data privacy, it’s all in the cloud anyway.”

That’s like saying you don’t bother locking your office door because the alarm company exists.

Because here’s what happens when (not if) a breach occurs:

Your firm’s reputation is instantly on the line.

Your clients’ trust evaporates overnight.

Regulators, insurers come knocking.

And suddenly, “we weren’t worried about data privacy” becomes Exhibit A in an investigation.

The choice to build AI internally magnifies this risk. You’re now responsible for:

How and where client data is stored.

Who has access.

Encryption, audit logs, backups, and compliance with GDPR and the UK Data Protection Act.

Securing APIs that connect multiple third-party systems.

Unless your firm has the cybersecurity budget of a global bank, you’re one unpatched server away from a crisis.

By contrast, when you buy from a trusted partner like Bots For That, data security and compliance are built into the product design.

houbeanie and beanies operate within a controlled, audited, and fully GDPR-compliant environment, ensuring that all data is used only within the boundaries of the firm’s authorisation, and never exposed to public models or external networks.

In short: we lock the doors, guard the data, and leave you free to get on with the accounting.

Why the Smart Money Buys

Banks learned this lesson the hard way, their engineers were pulled off revenue-driving work to chase compliance efficiency. Accounting firms face the same trade-off. The opportunity cost of building AI in-house is enormous.

Buying from a specialist platform like Bots For That means you get:

Speed to value: deploy in weeks, not months.

Data privacy by design: client data stays within your secure environment.

Compliance assurance: GDPR, FCA, and ISO-aligned standards.

Cross-platform compatibility: works with your existing systems.

Predictable costs: subscription, not speculation.

Less engineering. Fewer sleepless nights. More client trust.

How the Equation Changes by Firm Size

Micro Firms (1–10 staff)

Buy and breathe.

Your priority is client service, not server security. A ready-made agent like houbeanie handles data queries, reconciliations, and client messages without storing or transmitting data outside your firm’s environment.

You get capability with zero infrastructure risk.

Small to Mid-Size Practices (10–50 staff)

Buy first, build later, safely.

Start with proven, compliant agents to automate high-volume work (bank recs, client comms, onboarding). Once your workflows and permissions are defined, consider customising your “task beanies” to extend functionality securely.

Regional & Mid-Tier Firms (50–250 staff)

Adopt a hybrid model, but govern tightly.

You have the data and the scale, but also greater exposure. Use pre-built beanies for core automation, and build on top only within a controlled governance framework. Always separate production and testing data. Your clients trust you to protect their books. Make sure your systems live up to that trust.

Top 25 Firms

Selective build, strategic buy, zero compromise on data.

You’ve got compliance teams and IT budgets, so use them wisely. Buy secure agent frameworks for operational use, and build your differentiating layers (advisory logic, dashboards) on top.

houbeanie’s enterprise-grade governance and audit trail give you visibility, version control, and data sovereignty at scale.

The Balanced View

There are valid reasons to build: if your data or workflows create a proprietary advantage, or if you want complete control over AI behaviour. But you also take on complete responsibility, not just for what your agent does, but for every byte of data it touches.

For 95% of accounting firms, buying isn’t just faster, it’s safer. It’s a governance decision as much as a financial one.

Because when the inevitable data incident happens somewhere in the industry, the firms who chose to buy secure will sleep soundly, while those who built carelessly will be explaining themselves to clients, regulators, and lawyers.

The Final Sum

AI Agents are about amplifying accountants, not replacing them, but they also expose who’s thinking responsibly.

Building in-house delivers incremental progress, and maximum liability.

Buying securely delivers geometric growth, and built-in protection.

With houbeanie, beanies, and the beanieverse, data stays protected, workflows stay auditable, and your firm stays compliant, while your team focuses on clients, not cyber risks.

That’s the smart side of the build vs buy equation.

And frankly, when it’s your clients’ data on the line, there shouldn’t even be a debate.