Outsourcing VS Automation: The Debate that Continues

For years, accounting firms have searched for ways to cope with growing workloads, shrinking deadlines and the ever present pressure to do more with less. Two solutions have dominated that conversation: outsourcing and, more recently, AI driven automation.

While both aim to solve similar problems, the way they do it, and the results they deliver, are worlds apart. And yet, the debate continues.

So let’s break it down.

What does outsourcing really mean for accounting firms?

Outsourcing, whether overseas or within the UK, is the practice of handing specific tasks or processes to an external team. This could include bookkeeping, accounts preparation, payroll, or admin heavy work that firms struggle to resource internally.

Accounting firms typically turn to outsourcing for a few key reasons:

✧ Difficulty recruiting skilled staff locally

✧ Rising salary and overhead costs

✧ Seasonal workload spikes, especially around tax deadlines

✧ Pressure to maintain margins while growing the firm

✧ Staff burnout caused by repetitive, manual tasks

On paper, outsourcing looks like a neat solution. Work is offloaded, capacity is freed up, and the firm can focus on higher value services.

But the reality is often far more complicated.

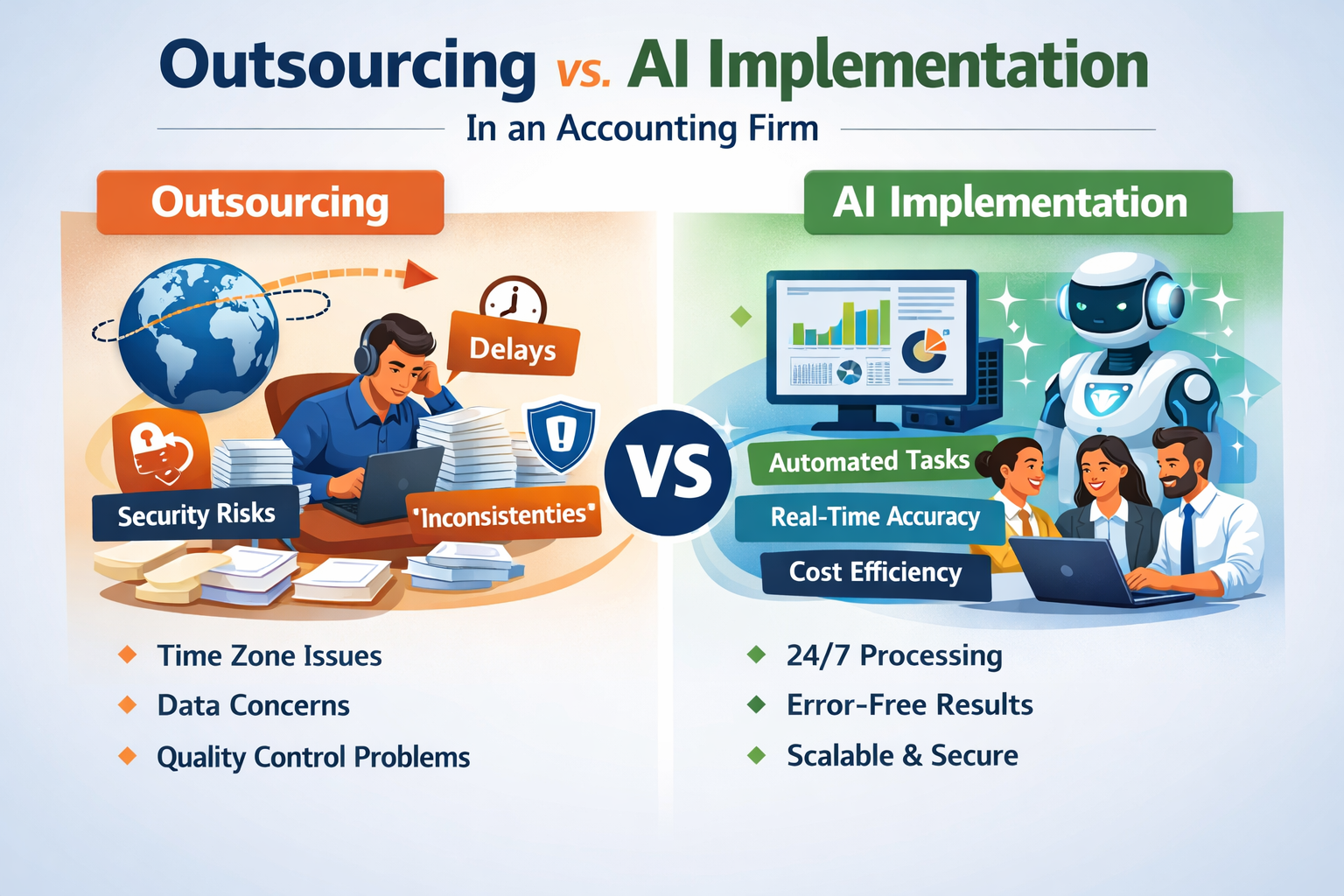

The uncomfortable truth about outsourcing

Outsourcing is not without its risks, and many firms only realise this after they are deeply invested.

Some of the most common downsides include:

Reliability issues

Staff turnover, sickness, or inconsistent performance can disrupt workflows. When the outsourced team struggles, your firm absorbs the impact.

Security and data concerns

Client data is one of your most valuable assets. Sharing access externally introduces additional risk, especially when dealing with overseas providers and varying data protection standards.

Communication friction

Differences in time zones, language, and process understanding often lead to delays and misinterpretation.

Quality control overhead

Outsourced work still needs reviewing, correcting, and managing. In many cases, firms simply shift the workload rather than reduce it.

Lack of ownership

Outsourced teams are not embedded in your firm culture. They do not have the same accountability, context, or long term investment in your success.

Why automation and AI have moved far beyond outsourcing

AI and automation have evolved at an extraordinary pace, particularly in the accounting space. What started as simple rules and data entry tools has grown into intelligent systems that can understand context, follow workflows and operate consistently at scale.

Unlike outsourcing, automation does not rely on people logging in, picking up tasks, or interpreting instructions. It simply does the work.

Here is what automation can provide that outsourced teams cannot.

Always on capacity

Automation works around the clock. There are no time zone delays, no handovers, and no waiting for availability. Tasks are completed the moment the data is ready.

Consistency and accuracy

AI follows the same rules every time. It does not forget steps, misunderstand instructions, or apply personal judgement inconsistently. This dramatically reduces rework and error rates.

Scalability without disruption

As your firm grows, automation scales instantly. You do not need to recruit, onboard, or retrain additional resources to handle increased volume.

Deep integration with your tech stack

Automation works directly inside your accounting software, practice management tools and reporting systems. There is no exporting, emailing, or manual checking required.

Real time visibility

AI driven tools provide instant insight into what has been completed, what is in progress, and what needs attention. No chasing updates. No uncertainty.

Cost predictability

Automation costs are fixed and transparent. You are not paying per hour, per task, or per person. There are no surprise invoices or hidden inefficiencies.

Freedom for your internal team

By removing repetitive tasks, your existing staff can focus on advisory, client relationships and meaningful work that actually grows the firm.

Outsourcing moves the work elsewhere. Automation removes the work entirely.

Are there downsides to AI and automation?

Of course. No solution is perfect.

AI and automation require:

✧ Clear processes before implementation

✧ An initial setup and learning phase

✧ Trust in technology and a mindset shift within the firm

✧ Ongoing governance to ensure rules remain accurate

However, these downsides are temporary and controllable. Once implemented correctly, automation becomes a stable, dependable part of your firm rather than an ongoing management challenge.

Unlike outsourcing, automation improves over time rather than introducing new variables.

The why of AI: a glimpse into the modern accounting firm

Picture this.

An accounting firm starts the day with clean dashboards showing exactly where every client stands. Bank reconciliations are already completed. Reports are up to date. Tasks have been triggered automatically based on client activity.

The team logs in without dread. No one is buried in repetitive work. Instead, conversations are about insights, opportunities, and how to better serve clients.

Deadlines are met calmly. Capacity issues are rare. Growth feels manageable, not chaotic.

This is not a futuristic dream. This is what happens when AI is embedded properly into a firm’s processes. Work flows instead of piling up. The firm runs proactively rather than reactively.

The conclusion: The debate is ending

Outsourcing had its moment. It was a necessary response to broken processes and mounting pressure.

But today, it is increasingly outdated and clunky.

AI and automation do not just replace outsourced labour. They fundamentally change how accounting firms operate. They remove friction, reduce risk, and create space for firms to do their best work.

If you are still debating outsourcing versus automation, it may be time to ask a different question.

What could your firm look like if the work simply took care of itself?

Get in touch to discover what AI can really do for your firm.